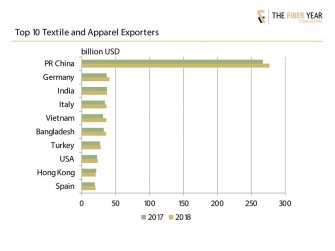

Most of the top-10 exporting countries lifted their shipments in value terms in 2018 (Figure 1). The recovery of Chinese exports continued with the total value increasing 4 percent to US $277 billion. However, value-added garment exports remain about 15 percent below their peak 2014 level, without any significant movement over the past three years. Knitwear and woven apparel exports remain among the top-10 Chinese export categories, albeit gradually losing weight as the Chinese economy continues to diversify.

Vietnam and Bangladesh were two prominent beneficiaries from intensifying trade tensions between the United States and China. Following the implementation of China-specific tariffs by the U.S., Vietnam’s garment and textile exports exceeded US $36 billion in 2018, up 15 percent. In 2019, Vietnam’s exports are expected to top US $40 billion in 2019, benefiting from continued U.S.-China trade tensions and further free trade agreements; notably Vietnam signed a free trade agreement with the European Union in June of this year, as well as a recent agreement with Canada. Although Vietnam’s sales into the U.S. account for more than a third of its exports, the country’s expansion of exports in 2018 was primarily driven by double-digit growth into Asian markets and the European Union.

The importance of textiles and apparel to Bangladesh is apparent, as its share in total exports remains one of the highest in the world at about 90 percent, with 2018 shipments surging 11 percent to US $36 billion. Bangladesh has signed recent free trade agreements with Brazil, India, Pakistan and Turkey. Bangladesh does face several potential limitations on further increasing trade, including regulatory non-compliance, quality and factory safety concerns among buyers, trade protection by export destinations, political tension, a lack of infrastructure, and rising production costs driven by a 51 percent increase in the minimum wage in December 2018.

Uncertainties from trade and future market access, as well as from potential oil supply disruptions due to geopolitical risks in key oil producing regions, will put multinational supply chains into question and weigh on investments.Uncertainties from trade and future market access, as well as from potential oil supply disruptions due to geopolitical risks in key oil producing regions, will put multinational supply chains into question and weigh on investments.

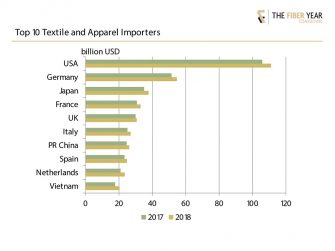

All leading importing countries have lifted imports with double-digit growth rates in dollar terms (Figure 2). Imports into the United States in 2018 rose 5 percent to the second-highest value in history at US $111 billion. China’s deliveries to the U.S. rose 5 percent to US $41 billion, but China’s market share has fallen from its peak of 41 percent in 2010 to below 37 percent in 2018. Vietnam‘s share of the U.S. market further gained weight to 12 percent after expanding 6 percent to US $13 billion; India reached a new peak for deliveries into the U.S. in 2018 at US $8 billion, and Bangladeshi value into the U.S. rebounded 6 percent in 2018 after consecutive annual declines in 2016 and 217 to US $6 billion. The import value into Japan rose 3 percent to US $38 billion, which resulted in Japan’s second largest textiles and apparel deficit in history – bested only by 2014 – at US $30 billion.

China-made apparel still is clearly taking the lead, but its market share has steadily weakened. Chinese apparel imports marked a peak in 2008-2009, with a share of 84 percent, while the 2018 ratio accounted for 60 percent, which is China’s lowest mark in this century. The flow into the European Union increased 7 percent to US $136 billion from outside the region. Germany and the United Kingdom are the two largest sales markets, absorbing one third of total imports despite negative growth in the previous three years. All leading suppliers were close to or above all-time high, except for China, which was 6 percent below the peak in 2015, and Tunisia. Changes in regional terms may be coming following the EU Commission’s announcement in November 2018 that it was considering a withdrawal of trade preferences for Myanmar and Cambodia due to concerns about human rights.

Considering both trade flows (import/export), China improved its surplus to US $251 billion, while Indian surplus slightly declined to US $30 billion, and Bangladesh improved to US $25 billion. The United States remained the market with the largest deficit at US $88 billion, followed by European Union with extra-EU trade deficit at US $76 billion and Japan.

Uncertainties from trade and future market access, as well as from potential oil supply disruptions due to geopolitical risks in key oil producing regions, will put multinational supply chains into question and weigh on investments. Hence, possible shifts in trade flows are on the horizon, and 2019 full-year results will deliver interesting results unless political decisions deal a new hand.

This article is based on material abstracted from the textile yearbook, The Fiber Year, which covers global trends in manmade and natural fiber production, including nonwovens and unspun materials. The Fiber Year covers trade data for main markets and contains several contributions from industry experts in the area of biopolymers, cotton, viscose, and wool, as well as textile machinery shipments. A table of contents is available at www.thefiberyear.com.

In the next installment of “The Fiber Year” column, look for a status update and outlook for major manmade fiber raw materials.