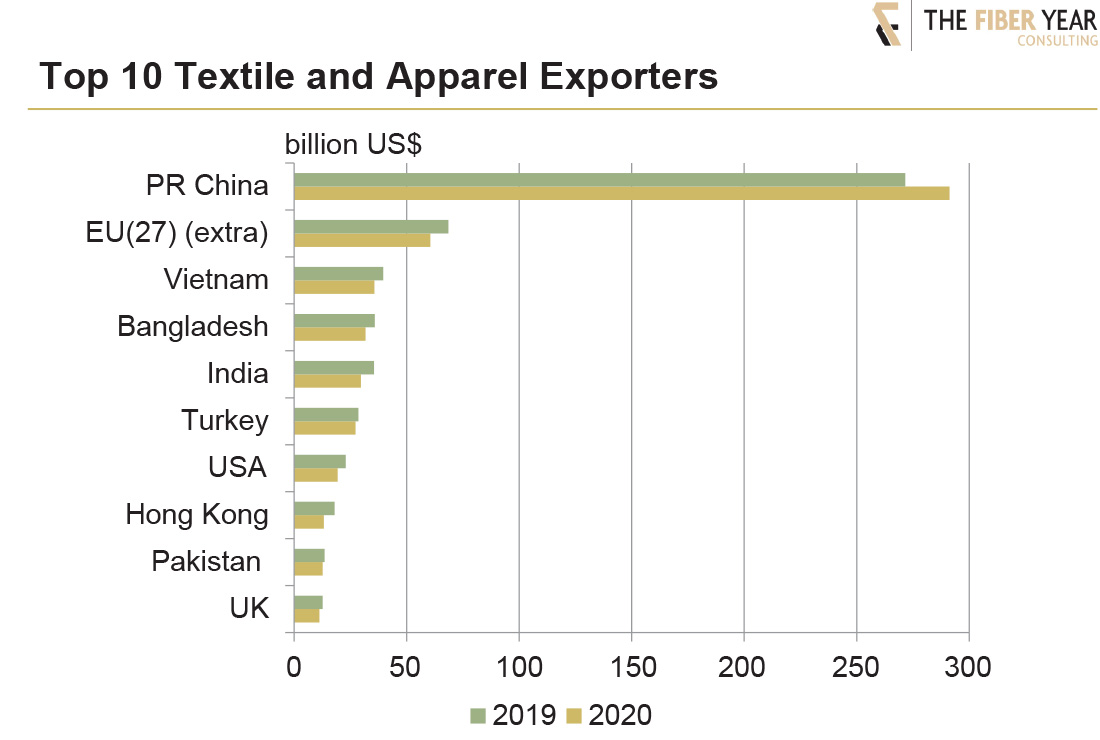

The Fiber Year, now in its 21st edition, includes textile and clothing trade data for 60 countries, of which the vast majority contracted at double-digit rates. Just two industries out of the 20 largest exporting nations, with the European Union viewed as an entire region included, managed to grow their export values. China’s surging facemask shipments compensated for the six-year decrease in apparel exports and Brazilian exports, typically dominated by raw cotton, continued increasing after a bumper crop. Other industries suffered from losses between 4% in Turkey and 27% in Hong Kong. Improvements have been witnessed in several countries in the first half 2021, but it is certainly not a broad-based recovery with countries like Bangladesh, Indonesia, Korea, Sri Lanka and Thailand not yet reaching pre-crisis level.

Exports from China’s industry rose 7% to US$291 billion, hitting their second-largest value in history, after textile shipments surged 28% to US$154 billion, essentially driven by facemask shipments. Apparel exports continued their downward tendency, down 9% to US$137 billion, which was almost US$50 billion below their peak in 2014.

The remaining top-10 exporters recorded joint losses of 12%, equal to a US$34 billion shortfall. Turkey succeeded to mark the best trade performance behind mainland China, with export value falling 4% to US$27 billion and trade surplus hitting a new all-time high, after benefiting from retailers shifting orders away from PR China in January and February and steady positive growth rates from June. The performance in exports was partly owing to price concessions, e.g., more than doubling of polyester staple fiber shipments while the unit price contracted to the lowest level in the century. Bangladesh and India were hardest hit with export values in April plummeting more than 85% each. U.S. exports recorded double-digit declines along the chain as a result of reduced consumer spending for apparel and lower regional demand for yarns and fabrics due to extended lockdown measures and several disruptions from the record-breaking Atlantic hurricane season, which caused additional challenges in logistics.

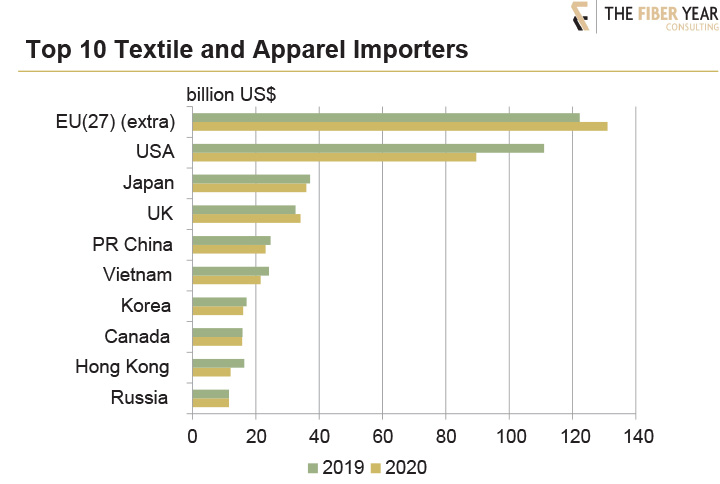

Top 10 import destinations scaled foreign sourcing back 5% to US$391 billion, with the largest loss of US$21 billion into the U.S., while imports into the 27-nation EU were lifted 7% with a tripled value of other made-up textile articles, essentially facemasks, but both knitwear and woven garment purchasing fell at a double-digit rate. Imports into most Asian countries also contracted at a double-digit pace, in direct response to depressed overseas apparel orders, whereas strong growth into Pakistan was a direct response to domestic cotton crop failure and another 33% contraction in cotton harvesting was predicted for 2020/21 season. Vietnamese purchasing was 11% lower, primarily following reduced raw cotton, unspun fiber and fabric imports for domestic processing.

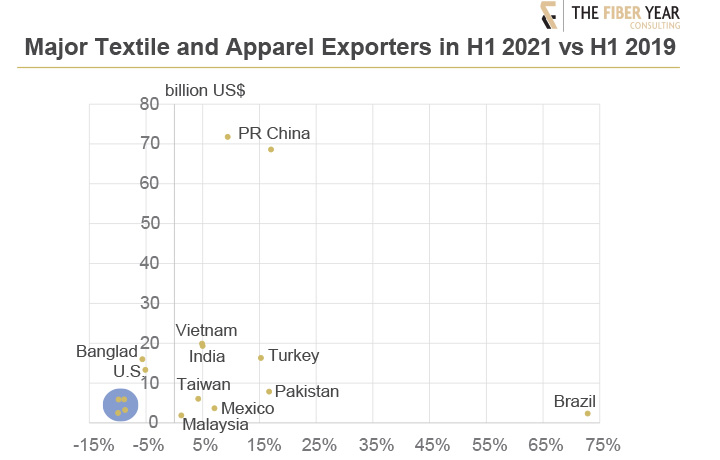

The expectation for 2021 exports is to see an improvement, which has been witnessed in several countries based on six-month data, but it is certainly not a broadly-based recovery. Countries in the blue marked circle in Figure 3, comprising Indonesia, Korea, Sri Lanka and Thailand, remain 9-10% below their pre-crisis level. Nearly all continued to suffer from steep year-on-year cutbacks in January and February.

A strong recovery is visible for Pakistan and Turkey. The business in Pakistan will essentially be driven by imports of raw cotton and manmade fibers, making the industry a promising fiber sales destination with all types clearly exceeding last year’s levels. First half export value already soared by 17%, a little faster than the 15% growth in Turkey exceeding US$16 billion.

Ongoing growth is projected for Brazil and PR China. Skyrocketing export value expansion from Brazil of more than 70% benefits from increasing cotton prices that by late August had reached their highest level since February 2012.

China’s rise in exports includes textile articles and apparel after multi-year declines. The performance in textiles is 17% above the pre-crisis level, but 7% below last year’s same period, which is believed to be the result of a general drop in prices of facemasks rather than significant reductions in quantity.

Apparel exports gained 9% to US$72 billion, and full-year results may lead to a trend reversal after six years of gradual decreases.

The next installment of “The Fiber Year” column will summarize the webinar “The Fabric Year 2021,” which The Fiber Year GmbH will present in partnership with Groz-Beckert KG in early October 2021.