The Fabric Year, a result of the cooperation between Groz-Beckert and The Fiber Year GmbH, now in its seventh edition delivered insights into textile markets, taking a holistic approach from fibers to fabrics. The general idea is to bridge fiber and filament manufacturing with subsequent processing activities in knitting, weaving and nonwovens fabric production.

The three processing technologies witnessed different developments with sharp contractions across the globe in both knitting and weaving, while nonwovens recorded an unprecedented push last year due to outsized demand for hygiene and medical applications.

This digital event offered a half-hour executive summary in early October with a stream, including Chinese subtitles, now available in the Groz-Beckert media center and on YouTube.

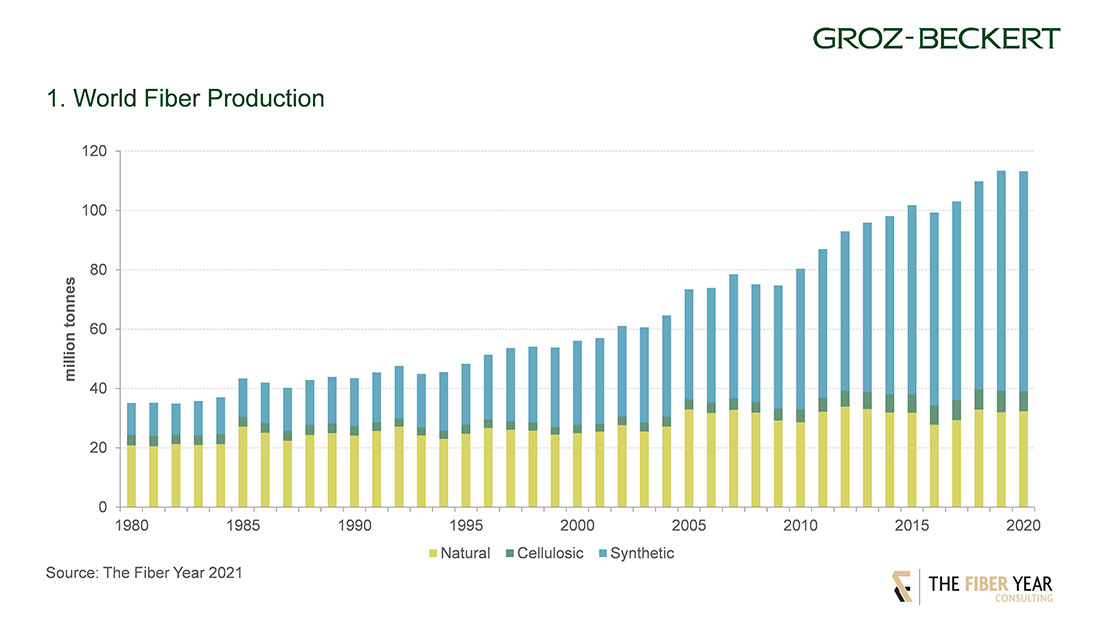

World fiber supply was razor-thin in the red. Global market size accounted for 113 million tonnes, which refers to an average 14.5 kg supply per head. World natural fiber supply experienced a modest recovery as the decision for planting was already made ahead of the pandemic. Manmade fibers recorded an almost unchanged volume of synthetics while wood-based cellulosics suffered from contraction. In total, the manmade fiber business saw surprisingly robust production in China, whereas all other industries across the globe jointly contracted at a double-digit rate.

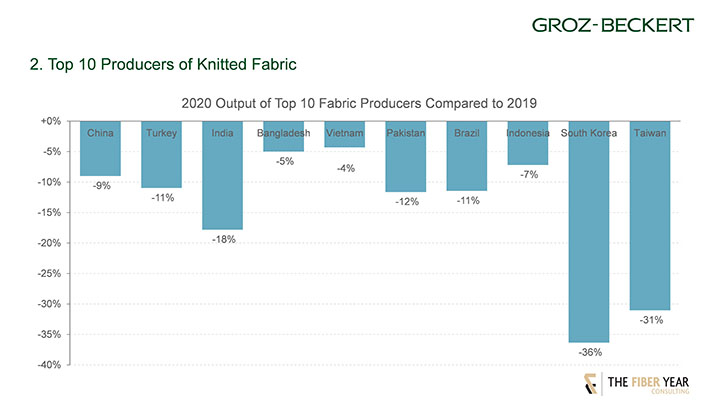

Textile processing certainly did not escape the worst of the pandemic. But the effect was definitely not evenly felt across all fabric production technologies, and primarily due to its low cost, high speed and flexibility, knitted fabric fared well – all things considered. In 2020 the total global output of knit fabric was around 11% lower than 2019.

At the beginning of last year, lockdown in China and the subsequent closures of apparel and fabric manufacturers created a scramble amongst buyers to find suppliers elsewhere to fill their orders. At the beginning of the year, India and Turkey were two major benefactors who saw quite a sudden jump in orders. Turkey especially benefited from close proximity to Europe. Unfortunately, by the second quarter, the triple blow of coronavirus reaching the country, scarce supply of raw materials and subsequent increase in yarn and fiber prices added massive pressure on knitters and apparel manufacturers.

So, by the end of 2020, we could see that in almost every country the output of knit fabric decreased, with a few notable exceptions, such as Vietnam, which maintained a fairly stable fabric output, decreasing only 4%.

China remained overall the number one producer of knit fabric last year, 9% lower than 2019. And considering that the industry effectively shut down in March and only really began to start operating again in April, this is quite exceptional.

Importantly, the retail dynamics of the pandemic played perfectly into the hands of major sportswear exporters, like China and Vietnam. Worldwide home-office requirements, social distancing and a shift in work-life balance for many people resulted in a huge increase in demand for sportswear and leisurewear. People discovered sports, running, cycling or just being outdoors as opposed to being in the office. At the same time a significant decrease was seen in formal office wear, shirts and trousers.

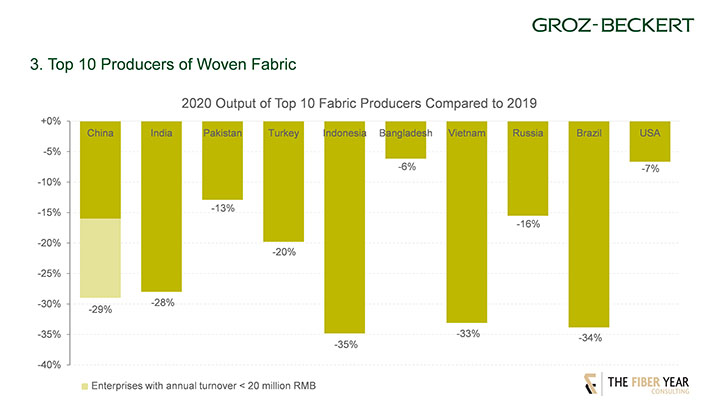

In contrast to knitting, we have seen a very different development of weaving industry. Total production of woven fabric declined by close to 28%.

Where knitters and knit apparel manufacturers have gained tremendously from social and lifestyle changes, the opposite can be said for weavers – at least in terms of apparel. On the demand side, woven fabric manufacturing was hindered significantly in 2020 by reduced demand for formal and office wear, mainly shirts and trousers. But while woven fabric appetite took a hit, interest in home renovation saw a strong increase during the pandemic, and many weavers have had a boost from increased demand for woven fabric used in furniture, like sofas, curtains and rugs. In general, we observed quite low operational capacities amongst weavers in 2020, and after the early stages of the pandemic, most were getting by primarily based on backlogged orders from before the lockdown.

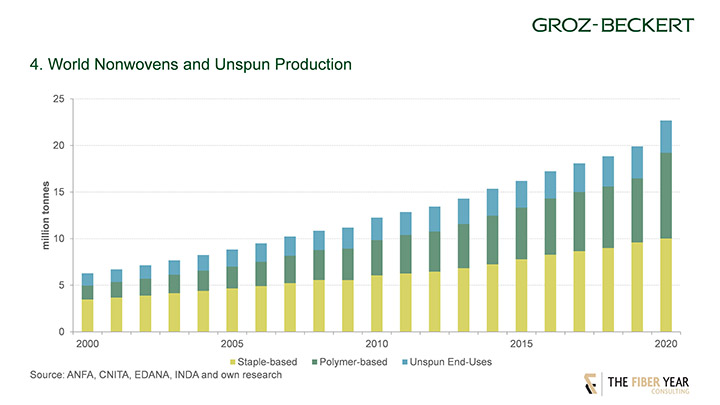

Pre-crisis nonwovens demand has witnessed continuous growth in the century, even though financial crisis and slow economic recovery have led to temporary deceleration. Nevertheless, it managed to outperform the annual increment of the world fiber market before witnessing an unprecedented push last year due to outsized demand for hygiene and medical applications. Surging demand in disposable products for cleaning and disinfecting wipes, medical fabrics, filtration and facemasks lifted global nonwovens demand at an unprecedented speed while several other markets for durable goods suffered from pandemic-induced slowing, such as apparel, building, construction, geotextiles and mobility.

A unique development arose last year with dynamics across the globe in spunlaid production resulting in a 34% expanded volume. Output even soared a breathtaking 63% to around 5 million tonnes in China as the industry rapidly adjusted to new consumption patterns with sales of spunbond/meltblown lines exploding by 1,300% to 450 units in the first half 2020 and full-year facemask exports shooting to US$54 billion versus US$5 billion in 2019.

Double-digit growth rates were also observable in other Asian industries and Greater Europe, whereas the expansion in North America was comparatively moderate at around 5% with operating rates at full capacity.

The strategic advantage of the holistic approach is to see the interdependence in the value chain. Therefore, the chart is intentionally structured into fiber- and polymer-based nonwovens because any changes in fiber-based nonwovens do have a direct impact on the volume available for knitting and weaving and vice versa.

The next installment of “The Fiber Year” column will take a look at the world staple fiber markets.

View The Fabric Year presentation by Groz-Beckert and The Fiber Year GmbH here.