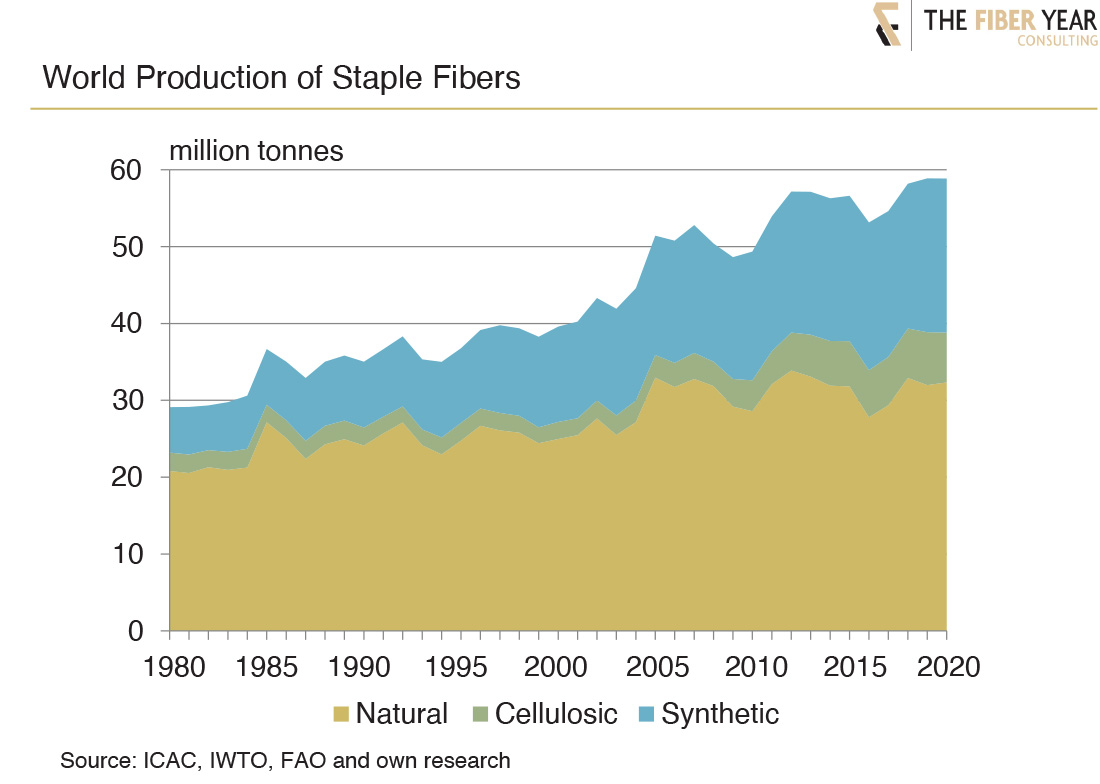

Global supply of staple fibers in 2020 accounted for nearly 59 million tonnes, 52% of the world fiber and yarn market. Their share continuously diminished from more than 80% in the 1980s. Development after the turn of the millennium clearly revealed a distinct tendency in favor of mainly wood-based types comprising viscose, modal and lyocell fibers. They started their recovery 20 years ago with dynamic growth just interrupted by the financial crisis of 2008 and the COVID-19 pandemic.

Long-term development over four decades revealed doubling of global supply, equivalent to almost 2% annual average growth. Market development in 2020 initially suggested marginal expansion of natural fibers, stagnation of synthetics and decline of wood-based fibers. This extraordinary performance appeared plausible as cotton planting decision was already taken before the pandemic, while manmade fibers quickly can be controlled to match demand. Subsequent revisions now assume a stagnation of natural fibers. Synthetic fibers marginally advanced to 20 million tonnes thanks to expansion of polyester and nylon, both marking long-term highs, and cellulosic fiber expansion came to a temporary halt after 11-year growth after declining to 6.5 million tonnes. The chart above originates from The Fiber Year 2021 based on April 2021 projections, and the new textile yearbook to be released in May will include a comprehensive update.

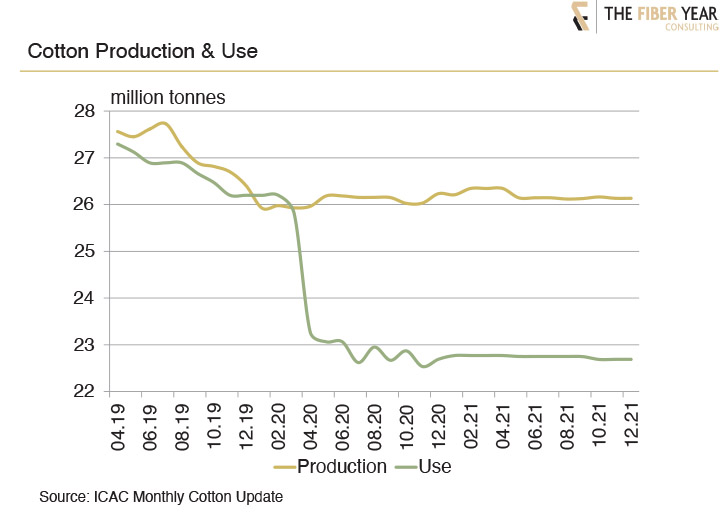

The pandemic pummeled the international fashion industry and most textile-related applications. The sharp revision of cotton use, unprecedented in dimension, was a direct response after the World Health Organization declared the outbreak of COVID-19 a pandemic on March 11, 2020. Revisions before were a result of continuous downgradings of the International Monetary Fund’s global growth projections. In addition, downgradings also affected other natural fibers. For example, flax with 80% of global supply originating from Europe ended its decade-long growth and another steep decrease is expected in 2021.

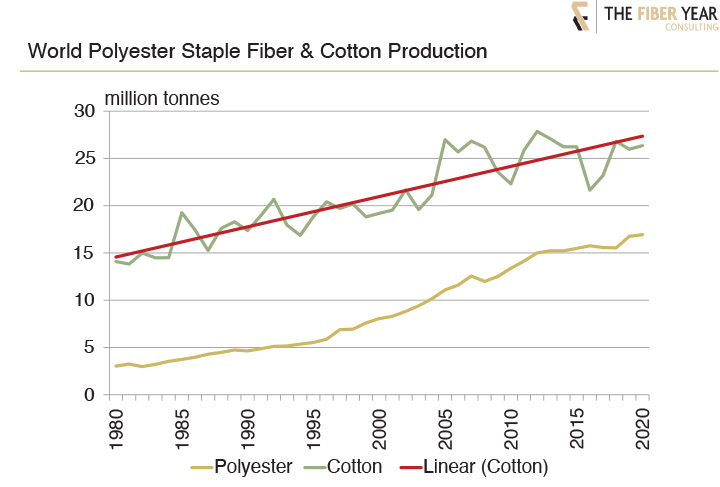

Polyester is the second-largest staple fiber and was the only type apart from small-scale nylon with growth in 2020, up 1% to 17 million tonnes. Chinese industry, occupying 62% global share, also suffered from slowing manufacturing due to lower recycled fiber output following the virgin material price spread further narrowing. In general, industry preferred standard blends such as CO/PES at lower prices as consumers cut spending on garment due to losses in disposable income.

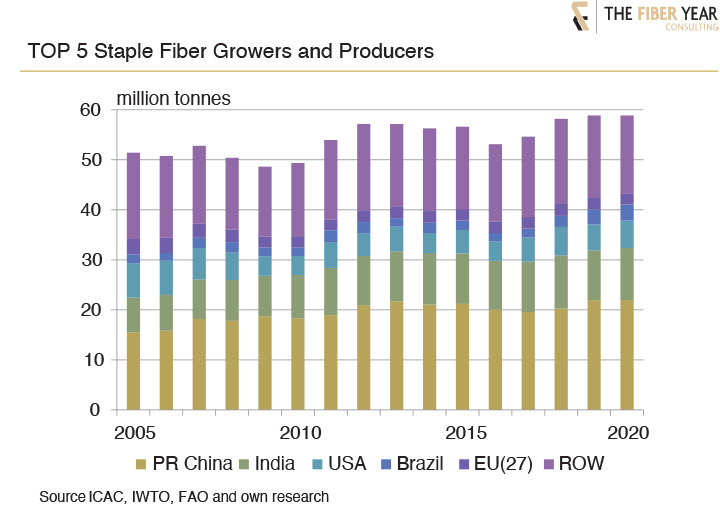

Supply in regional terms is highly concentrated with PR China, India, U.S., Brazil and European Union covering almost three quarters. They have also been heavily engaged in trading with PR China and EU taking in a net importing position during quota-free period. U.S. traditionally has been the world’s largest exporter of cotton and runs the largest fiber export surplus, predominantly resulting from more than 3 million tonnes cotton shipments as local use just accounted for around 10% of output while manmade fiber shipments were flat as CAFTA was shut 4-5 months and the typically strong cotton yarn export surplus mainly arises from regional trade agreements including yarn-forward provisions.

The movement of textile chain in Brazil continued to veer toward raw cotton exports, increasingly relying on sourcing manmade fibers abroad amid gradually shrinking local production while cotton cultivation hit all-time high harvesting in 2019/20 season after four-year growth of area and improvement of yields. However, domestic use at the same time shrank to just a fifth of actual production. Thus, total export surplus reached a historic high at 2 million tonnes, but cotton exports out of one port implies potential risk in case of temporary shutdown or impaired operation.

India has the world‘s largest cotton, coir and jute fiber cultivation and ranks second in manmade fiber supply. The country was the world‘s third-largest net exporter of fibers at 1.9 million tonnes next to U.S. at 3.3 million tonnes and Brazil at 2.0 million tonnes. The decisive bottleneck preventing higher value added production and finally enlarged apparel exports continued to be the midstream segment, although India houses the world‘s largest number of looms, of which the vast majority is installed in an unorganized sector.

The next installment of “The Fiber Year” column will take a look at the trend of spun and filament yarn production.