Global demand for resilient flooring is forecast to rise 3.9% per year to 3.7 billion square meters in 2022, outpacing growth for nonresilient flooring. Vinyl products – particularly LVT – are expected to gain market share, continuing the 2012-2017 trend. These and other trends are presented in Global Flooring, a new study from The Freedonia Group, a Cleveland-based industry research firm.

Global demand for vinyl flooring is projected to advance 3.9% per year to 3.1 billion square meters in 2022. These products will continue to expand their share of the global market as penetration of LVT rises, aided by improvements in digital printing that have increased their aesthetic appeal. Niche multilayer flooring products also offer strong prospects, although penetration remains limited, particularly outside of developed countries. However, the pace of gains will moderate somewhat relative to the 2012-2017 period, when a strong rebound in the US market boosted growth.

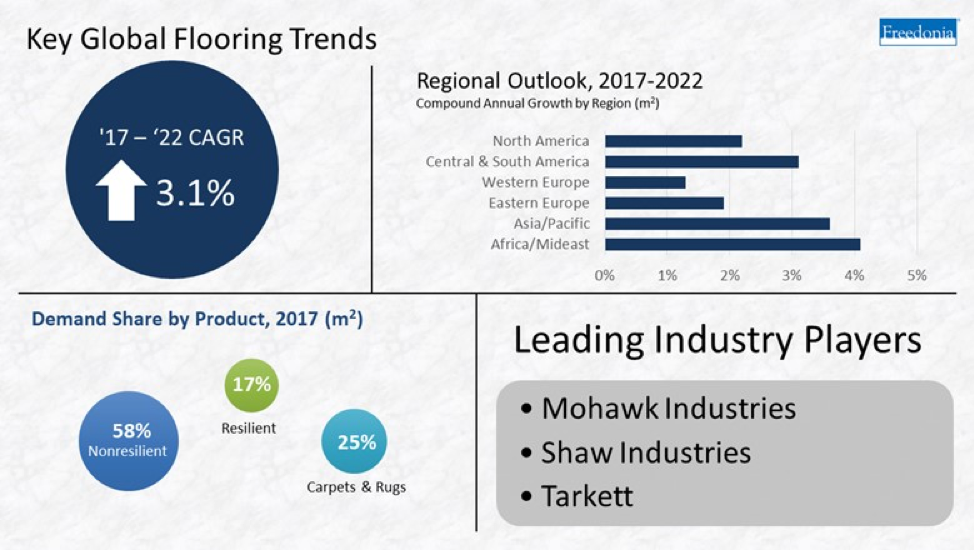

Global demand for all types of resilient and nonresilient flooring is forecast to rise 3.1% per year to 21.0 billion square meters valued at $226 billion in 2022. Growth will be driven by increased construction of new housing and nonresidential buildings and the higher spending on improvements and repairs in existing buildings. The industry will also see greater use of finished floor coverings relative to total floor space as standards of living improve worldwide.

Global Flooring (published 01/2019, 465 pages) is available for $6700 from The Freedonia Group. Please link citations to https://www.freedoniagroup.com/Global-Flooring-Market.html

About The Freedonia Group

The Freedonia Group is a leading international industrial research company publishing more than 100 studies annually. Since 1985, we have provided research to customers ranging in size from global conglomerates to one-person consulting firms. More than 90% of the industrial companies in the Fortune 500 use Freedonia Group research to help with their strategic planning. Additional Construction & Building Product studies can be purchased at www.freedoniagroup.com, www.marketresearch.com and www.profound.com.