The top five trends shaping global disposable hygiene.

Following slightly accelerated growth in 2020, driven in large part by unprecedented demand for disinfecting and antibacterial wipes, global retail disposable hygiene has eased into near pre-pandemic growth patterns, with heightened health awareness, enhanced product access and variety, as well as improved disposable income in developing markets being the key drivers.

As the world evolves past the pandemic-defined reality and into a “new normal,” the inquiry into what the future of disposable hygiene holds demands a closer examination of consumers’ increasingly simplified yet selective approach to personal health and wellness. Such an approach is manifested in consumers’ shift towards hygiene products and services that project true relevance, quality and value across the physical, emotional and planetary well-being axis, and will be further explored through five trends, including efficacy-value hybridity, clean wellness, sustainable consumerism, holistic care and personalization.

These trends have been developing for some time and fueled by the pandemic, will further shape industry directions and business goals.

Efficacy-Value Hybridity

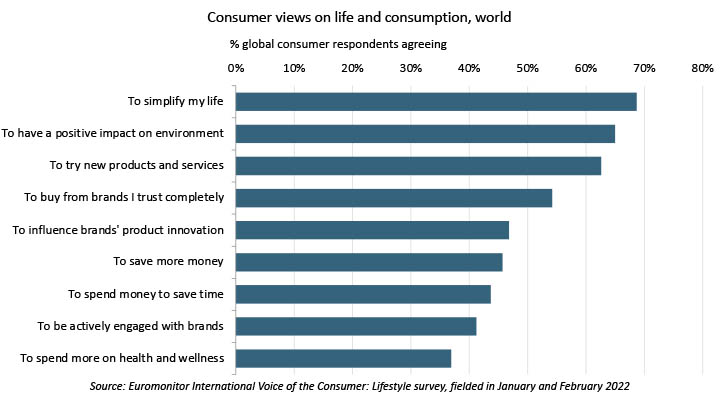

While grappling with this new reality of paying more for each unit of disposable hygiene products (per nappy/diaper or sanitary towel, for example), consumers are adopting a stripped-back approach, focusing more on trusted and efficacious products that offer the bigger bang for the buck. These sentiments are shared by consumers across age cohorts and income buckets, especially among younger and higher-income ones.

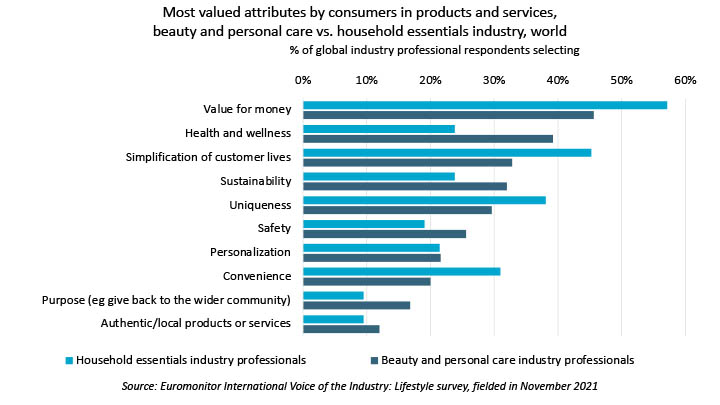

In fact, in Euromonitor International’s Voice of the Industry Lifestyles survey, more than half of global business professionals across industries recognized “value for money” as the most valuable attribute consumers seek from their offerings. To realize near-term margin recovery and longer-term share gains, businesses must understand such consumer sentiments and foster perceptions of higher quality by clearly and transparently indicating performance, convenience and safety in product labeling, third-party certifications and digital marketing. Companies stand to benefit and so do the offerings that involve experts and trustworthy influencers as part of guidance, recommendations and product development.

Clean Wellness

The concept of clean wellness in disposable hygiene is rooted in a drive toward simplicity in all phases of product development, prioritizing a no-frills approach that instills authenticity, ethics and credibility.

Pandemic-reinforced health and wellness awareness has accelerated clean ingredients’ rise to the new default, as consumers increasingly associate plant-derived, non-toxic ingredients such as organic cotton, bamboo and hemp with health and, in many cases, sustainability. Claim-making is a key avenue for businesses to communicate their clean positioning with consumers.

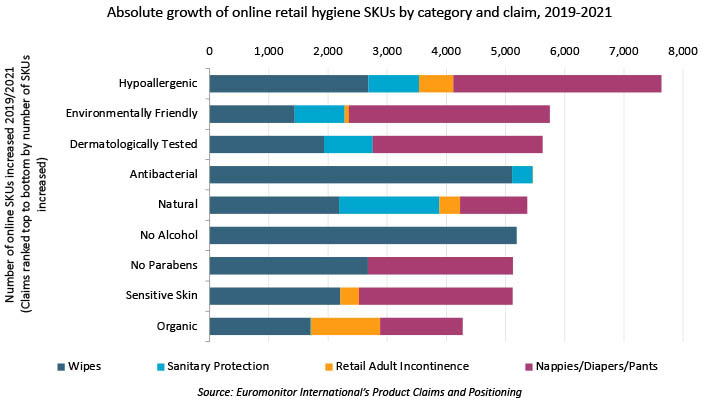

Not all clean claims are considered equal. Claims conveying specific, tangible benefits and absence of harm such as “hypoallergenic,” “natural,” “no alcohol” and “no parabens” have witnessed strong growth in the number of claim-associated SKUs in e-commerce since prior to the pandemic, according to Euromonitor International’s Product Claims and Positioning system.

The development of the clean claims, however, remains uneven across geographies and product categories, signalling potential growth offered by “white spaces.”

Geographically, developed regions such as North America, Australasia and Western Europe have led the penetration of clean claims, while Asia Pacific, despite its notable size of market, fell behind. Further consumer education could bring clean development in Asia Pacific to the next level.

Product wise, wipes, particularly baby wipes, led in online proliferation of clean claims in 2019-2021 such as “no alcohol” and “natural,” while retail adult incontinence appeared lagging, which can be partially attributed to technical barriers in balancing functionality such as absorbency with plant-derived ingredient usage.

To hit the right note with clean claims, businesses need to prioritize the ones translating tangible values and be mindful of regional and category nuances.

In the context of sustainability, reusable hygiene goods such as washable period and incontinence underwear have fared particularly well among Millennial and Gen Z consumers.

Sustainable Consumerism

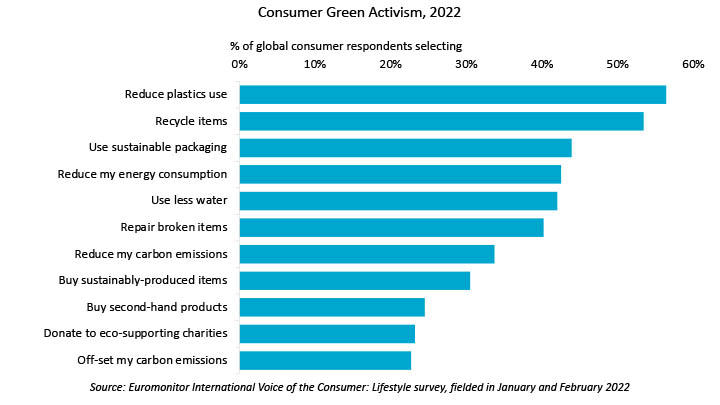

Growing consumer demand for purposeful living and environmental stewardship as key components linked to better health and well-being will also continue shaping brand strategy.

When it comes to consumers’ sustainability actions, reducing plastics use, recycling and using sustainable packaging are among the top priorities, according to Euromonitor International’s Voice of the Consumer Lifestyles survey. Such priorities inform key sustainability pillars for investment in the coming years. In fact, the industry is already responding by, for instance, exploring plastic-free, plant-derived materials such as bamboo and hemp, exploring recycled paper and reusable packaging, switching production energy source to greener alternatives such as solar and wind, as well as leveraging partnerships to scale composting, recycling and upcycling programs.

In tandem with these actions, businesses will benefit by communicating with claims indicating credibility and tangible benefits tied to these green initiatives, such as “plastic-free packaging,” instead of overly generalized “environmentally friendly,” for example.

Also, in the context of sustainability, reusable hygiene goods such as washable period and incontinence underwear have fared particularly well among Millennial and Gen Z consumers. While commonly considered as disruptors to disposable hygiene products, they are also offering synergy opportunities for businesses looking to expand their sustainability branding and carve out new growth avenues beyond core product offerings, as manifested in Kimberly-Clark’s acquisition of THINX and Essity’s purchase of Modi Bodi and Knix.

Holistic Care

The pandemic has accelerated the more simplified yet holistic sense of self-care that expands beyond the regular routines and isolated health symptoms, with much higher considerations of lifestyle conditions from skin to sexual, from gut to mental health, across life stages.

For companies, such shift to viewing health and wellness in a broader sense has brought further scope for multifunctionality and convergence of adjacent categories, as indicated by the rise of hybrid menstruation-incontinence options such as Procter & Gamble’s One by Poise in North America, Kimberly-Clark’s 2-in-1 line under Kotex in Turkey and Essity’s Dailies hybrid pantyliner in Germany, as well as the proliferation of wellness- and lifestyle-centric brand positioning.

The holistic branding trend has been largely spearheaded by direct-to-consumer businesses in developed markets, such as period care brand Rael, feminine and reproductive care brand LOLA and senior care brand Because Market.

Moving forward, this shift towards holistic care will continue redefining personal hygiene and informing product development and business synergies across categories.

Personalization

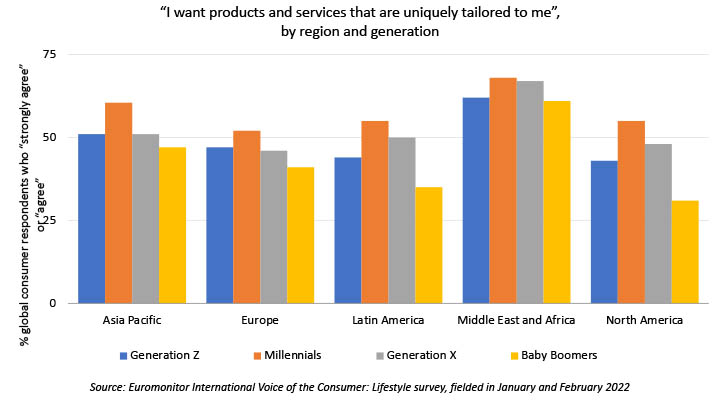

This progression towards simplicity and much sought-after assurance of safety and trust lends itself well to the evolution of personalization. The rise of digital business models, such as subscription services and smart wearable sensing technologies, are key contributors to the trend.

A subscription model, which provides personalized product and routine recommendations and allows consumers to tailor product mix and delivery frequency, has gained popularity, with 29% of global consumers currently using subscription services in 2022, up from 23% in 2019, according to Euromonitor International’s Voice of the Consumer Lifestyles survey. Convenience is ranked as the top driver. In fact, more than 50% of global industry professionals indicate they have accelerated tech investments around personalized recommendations due to the pandemic, according to Euromonitor’s Voice of the Industry Digital Survey.

Meanwhile, growing adoption of digital devices and the growing expectations for convenience and accuracy of personal care underpin the rise of smart sensors. These sensors are typically paired with absorbent incontinence goods to provide real-time user insights and predictive care guidance based on each user’s health patterns. Although such technologies are still in an early stage of development and more commonly deployed in institutions, their market potential will be further explored as the shift to at-home care gains momentum and the insights generated potentially feed into disposable hygiene goods’ R&D and commercial gains.

As challenges to scale personalization concepts and limitations in terms of precision predictive results and profiling and data privacy concerns remain, it will be key for businesses to ensure simplicity, affordability and security in order to democratize access to all.