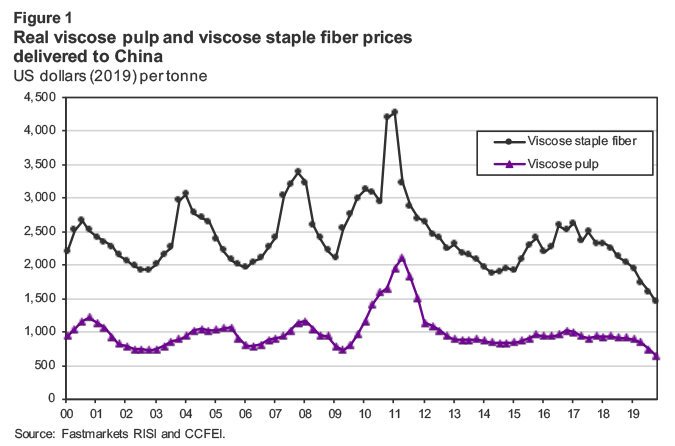

The current price of hardwood viscose pulp in China is $650/tonne. This is the lowest price in real (inflation-adjusted) terms in at least the last 20 years, and probably an even longer time period than that. Today’s price is 10% less than the previous lows posted in the fourth quarter of 2002 and the second quarter of 2009. The profound weakness in pricing is happening even as global demand is growing by an estimated 6%, about double the rate of the general economy. Obviously, other factors are overshadowing the positive influence of demand growth.

The most important negative factor is the associated weakness in paper-grade pulp pricing. Real paper-grade pulp prices have dropped sharply over the past year, but have not quite returned to the record lows set in 2009. At the low point for paper-grade pulp prices in 2009, the differential with respect to viscose pulp prices ballooned to more than $300/tonne. Now the differential is about $200/tonne. Viscose pulp pricing is more closely connected to paper grade pulp due to the proliferation of pulp lines that can swing between the two products. Nearly all new capacity that has entered the dissolving pulp market over the last 10 years is capable of swinging. Therefore, about 40% of global dissolving pulp capacity can now shift relatively quickly between paper grade and dissolving pulp. We estimate that the average cash cost difference between producing viscose and paper grade pulp is about $200/tonne, equal to the current price differential.

A final major factor undermining viscose pulp prices is the collapse of viscose staple fiber (VSF) prices in China. Nominal dollar prices are now 15% below the low point reached in the first quarter of 2009 and a whopping 30% less in real terms.

Another depressing factor for viscose pulp prices is the continuing expansion of the supply side of the market. After a lull in 2014-2016, investment in new viscose pulp capacity started to ramp upward again in 2017 and is continuing to accelerate this year. Our latest numbers show world capacity jumping 6% in 2019 and remaining on this trajectory next year. Most of the new supply is continuing to result from conversions of existing paper grade pulp lines, although two greenfield swing mills started at the end of 2018 in China and Laos. Two more conversions in Chile and Finland were finished in the fourth quarter of 2019, which will add about 800,000 tonnes per year of new viscose pulp supply when they reach full capacity, or a 10% addition to the global total. Along with the new capacity, world viscose pulp supply is being boosted by a shift back from paper grade to viscose pulp on existing swing lines due to the weak paper grade market.

Most of the new viscose pulp capacity is originating in the lower-cost Southern Hemisphere, unlike the situation in the first half of this decade when relatively small paper grade pulp lines were being converted in the higher-cost Northern Hemisphere. This shift is resulting in a significant drop in average production costs for the global viscose pulp industry. Data from the Fastmarkets RISI Mill Intelligence group show that real average cash costs for the global viscose pulp industry are 25% lower in the fourth quarter of 2019 than in the second quarter of 2009. Thus, cash margins for an average producer of viscose pulp are higher now than in 2009, despite real viscose pulp prices being 10% lower.

The dramatic expansion of viscose pulp capacity in lower cost regions of the world is exerting severe pressure on traditional producers. Viscose pulp mills in China based on cotton linters, which were historically the major supply source for the domestic VSF industry, are particularly vulnerable due to the high cost and volatility of cotton linters. Our figures show a 40% drop in Chinese cotton linter dissolving pulp capacity over the last ten years, with wood based viscose capacity rising rapidly to back-fill the void. We expect there to be additional closures of Chinese cotton linter capacity over the next few years, while wood based viscose pulp capacity will continue to gain share in the domestic Chinese market.

The recent downdraft in viscose pulp prices is also spreading the pain to the wood viscose pulp sector in China and higher-cost mills in Europe and North America. Using estimates from the Fastmarkets RISI Mill Intelligence group, it appears that roughly one-third of the global viscose pulp industry is currently at or below cash costs. As a result, one mill in Canada was forced to close indefinitely in December, while another mill in Brazil filed for bankruptcy protection in July and has had to take extended periods of production downtime throughout the year. The longer the current downturn in viscose pulp prices extends into 2020, the harder it will be for marginal producers to remain in operation, and the more likely there will be additional permanent closures.

A final major factor undermining viscose pulp prices is the collapse of viscose staple fiber (VSF) prices in China. Nominal dollar prices are now 15% below the low point reached in the first quarter of 2009 and a whopping 30% less in real terms. The real differential between VSF and viscose pulp prices is down to $800/tonne, more than $500/tonne less than in the first quarter of 2009 and more than $200/tonne below the previous low set in the first half of 2014. Massive investments by Chinese VSF producers in new capacity have resulted in industry operating rates dropping into the low-70% range, putting downward pressure on prices and margins. VSF producers, in turn, are exerting as much pressure as possible on viscose pulp prices.

Fastmarkets RISI has recently published its fourth detailed multi-client study of the world dissolving pulp market, Outlook for the Global Dissolving Pulp Market. This edition includes a forecast extending through 2030, showing the evolution of the market for another decade. The supply side will continue to shift toward the Southern Hemisphere since two large investments in viscose pulp capacity have been announced for Brazil. Aside from the timing of a price recovery, a big question will be if demand growth can be fast enough to absorb large supply additions or will smaller, older viscose pulp lines in the Northern Hemisphere continue to be driven out of the market? Many other issues are addressed on both the demand and supply sides of the dissolving pulp market, including the hi-alpha sector along with viscose pulp.

For more information on the Outlook for the Global Dissolving Pulp Market, visit www.risiinfo.com/product/outlook-for-the-global-dissolving-pulp-market/.