Global supply of staple fibers in 2021 accounted for 58 million tonnes which meant for the first time in history losing their majority share in primary spinning stage. This decline in the second consecutive year softened their share to 49%, down from more than 80% during the 1980s. Natural fibers suffered from the fastest contraction in five years while both synthetic and cellulosic fibers marked new all-time highs.

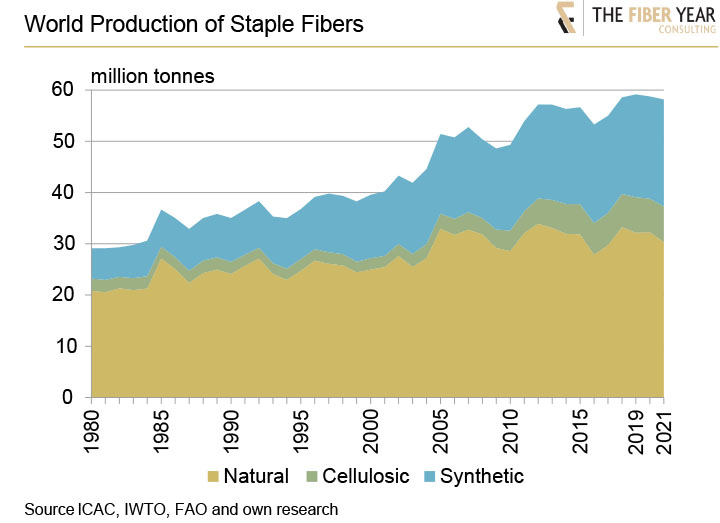

World Production of Staple Fibers

The global business of staple fibers has experienced modest growth in recent decades accompanied by structural changes in favor of manmade fibers.

The total volume doubled compared with 1980 to account for about 58 million tonnes while filaments enjoyed a tenfold increase during this period.

Synthetic fibers enjoyed fastest dynamics with an average annual growth rate of 3.1% since 1980 while cellulosic fibers including regular, modal and lyocell types expanded 2.7% annually. Natural fibers just advanced 0.9% on yearly basis despite the push in late 1990s after the approval of genetically modified cotton that helped to raise yields.

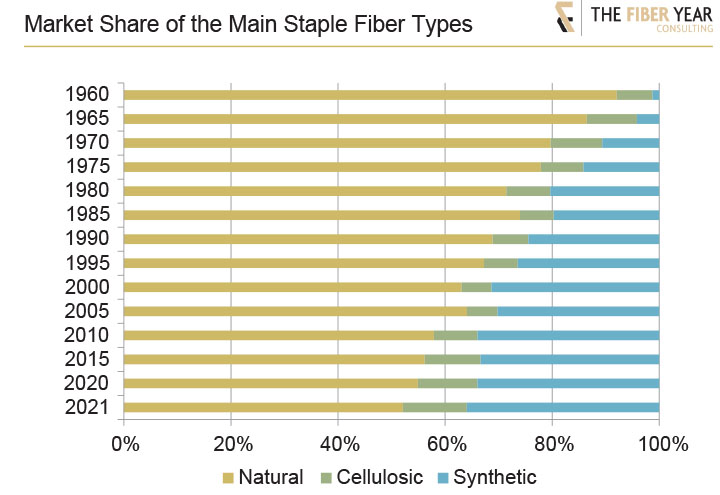

Consequentially, the staple fiber segment saw the relative position of natural fibers gradually softening from 72% in 1980 to 52% in 2021. On the contrary, synthetic fibers continuously gained weight from 20% to 36% at present. Likewise, cellulosic fibers succeeded to expand by doubling their market share within the recent 15 years to 12%.

The urgent search for sustainable and eco-friendly fiber materials will not only stimulate recycling investments but further push cellulosic fiber growth rates as visible from the number of projects in the pipeline for wood-based fibers, in particular lyocell, and biopolymers, such as PLA.

Six-Decade Market Position

The six-decade development of staple fiber supply illustrates an increasing usage of manmade fibers with in particular a slow movement of synthetics recently. Natural fibers share beyond 90% in early 1960s steadily lost weight. Availability of agricultural land, advantages in prices, security of supply, enhanced properties and economies of scale have been key drivers of the replacement process in favor of manmade fibers. However, weakening dynamics in synthetic fibers may be associated with the serious issue of plastic waste. The urgent search for sustainable and eco-friendly fiber materials will not only stimulate recycling investments but further push cellulosic fiber growth rates as visible from the number of projects in the pipeline for wood-based fibers, in particular lyocell, and biopolymers, such as PLA, which currently enjoy excess demand.

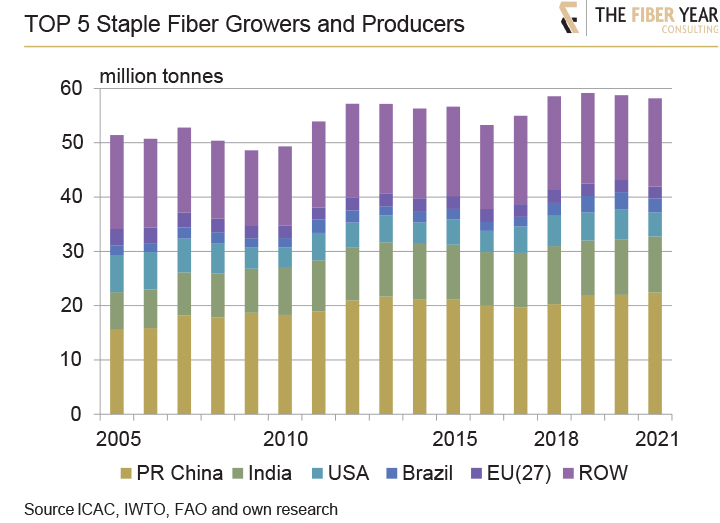

Staple Fiber Supply in Regional Terms

The four listed countries together with 27-nation European Union accounted for a 72% share in staple fiber supply in 2021, which was quite stable in the quota-free period.

The natural fiber predominance in India, world’s largest producer of cotton, coir and jute, was mainly destined for local processing while both American countries predominantly rely on exports with a joint fiber export surplus accounting for 6.6 million tonnes in 2021.

The fiber composition in PR China and EU(27) by the majority refers to manmade fibers. Chinese net imports of cotton and wool will remain to fuel downstream garmenting operations. On the other hand, massive polyester investments in the Chinese industry enabled the country to take in a net exporter status of manmade fibers since the financial crisis in 2008. Contrary, the long-term weakening of manmade fiber manufacturing in the European Union has resulted in steadily rising staple fiber imports during the quota-free period. The region’s net manmade staple fiber imports rose tenfold in quota-free period to 532,000 tonnes while the area established itself as a net cotton exporter after financial crisis.

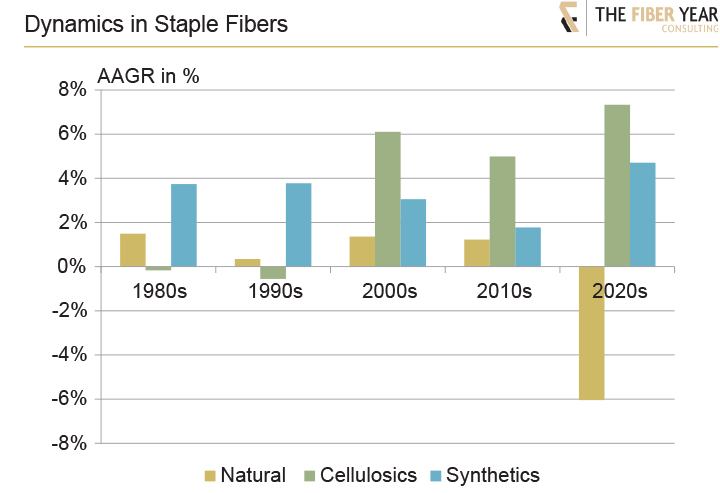

Multi-Decade Fiber Competition

The long-term performance has increasingly shifted in favor of manmade fibers. The steep drop of natural fibers was primarily result of the pandemic due to the time lag between planting decision and harvesting. Meanwhile, wood-based cellulosic fibers have outperformed market dynamics in the century, essentially due to strong gains in lyocell and modal volumes. The improvement in growth rates for synthetic fibers may in parts be assigned to the growing share of recycled materials from bottle chips. In total, the long-term average annual growth rate of natural fibers amounted to 0.9% compared with 2.7% in cellulosics and 3.1% for synthetics.