Hygienix 2024 Focused on Tailored Product Markets and Sustainable Options

The hygiene industry’s biggest challenge is achieving sustainability and market growth through innovative thinking. From period care to infant diapers to incontinence, items contain a complicated blend of plastics, fibers, and toxins that are harming the environment. There is no one-size-fits-all solution that can address all of the environmental challenges caused by hygiene products.

Furthermore, legacy hygiene providers that fail to innovate risk losing market share to emerging brands that rethink a more personal approach to delivering personal hygiene products. Emerging entrepreneurs are addressing these concerns with new product introductions, providing eco-friendly solutions as well as new methods to suit the consumer’s hygiene wants and needs.

Sizing Up the Market

We are all aware that the industry is vast. According to Precedence Research, the global feminine hygiene products market was valued at US $42.13 billion in 2023 and is expected to reach roughly US $89.29 billion by 2033, rising at a CAGR of 7.80% between 2024 and 2033[1] (Figure 1). The market’s growth is being driven by increased literacy about personal hygiene health.

They also report that the feminine hygiene products market in North America was estimated to be worth US $11.80 billion in 2023 and is expected to increase to roughly US $25.45 billion by 2033, with a CAGR of 7.98% from 2024 to 2033.[2] (Figure 2).

According to Statistica’s recently updated revenue predictions, the global infant diaper market revenue is expected to expand by US $18.7 billion (+32.86 percent) between 2024 and 2029.[3] Following the ninth straight year of growth, the indicator is expected to hit a new high of US $75.59 billion in 2029.

The global adult incontinence product market was valued at US $9.15 billion in 2024 and is projected to grow to US $15.09 billion by 2033, with a CAGR of 5.71% during the forecast period, according to Straights Research.[4] The North American market as a whole was valued at US $3.14 million in 2023 and is projected to grow at a CAGR of 7.62%, reaching US $6.08 million by 2032, reports Astute Analytica.[5]

With the predicted increase in these markets, the stage is set for global expansion. The question remains, where?

The Hygienix 2024 Conference, held in November in Nashville, TN and presented by INDA, the Association of the Nonwoven Fabrics Industry, included thought leaders, entrepreneurs, and experts who sought to provide those specifics on how and where to bring solutions to the future generation of consumers. Discussions primarily centered on infant care, adult incontinence, and femcare.

Where Is the Opportunity?

Setting the tone for the conference, Pricie Hanna, founding partner of Price Hanna Consulting, demonstrated why “the sun never sets on hygiene.” Speaking from a global perspective, one factor driving the market expansion of infant diapers is the trend to delay potty training children and increased use of training pants for toddler nighttime accident prevention and travel.

Globally, Africa is an opportunity region, as it is the only one in the world where the birth rate is really increasing. “In Southeast Asia, the birth rates are declining as are most countries in North America, Europe, South America, India, and in China the average regional birth rate is flat,” she elaborates.

“In the five largest countries – India, China, Indonesia, the U.S., and Brazil – while they are large, their future growth trends are declining, or are low, except for the region of China,” she went on to indicate. “However, we see major variations in the growth opportunities for market penetration. India has the greatest potential, whilst the United States market is already saturated. However, depending on the pace of penetration, these growth prospects are also tied with their economic progress.”

“Now, the million-dollar question is: where will global politics and trade go in the near future?” Hanna continued. “Well, there’s no answer. Continued volatility in the Middle East and Central Europe is to be expected.” Tariffs [from the new administration] will almost certainly have consequences, Hanna notes, but no one knows what they will be. “So simply keep watching. Our industry must continue to establish flexible supply networks and evaluate risk scenarios when making large investment decisions in areas where these challenges exist.”

Hanna concluded by summarizing the industry’s most serious difficulty. “Climate change is undoubtedly an ongoing big concern. Many, including INDA and EDANA, are working hard on this. Recycling technology initiatives have been demonstrated solutions, but I believe the current difficulty is how to gather and sort adequate amounts of the appropriate waste for each technology. Cooperation among industry, local communities, and governments is required to enable large-scale investment and recycling systems.”

On China

Ashley Wang, China National Household Paper Industry Association (CNHPI), discussed the “Latest Development of Disposable Hygiene Products Industry in China.” Key metrics include the rise in sanitary napkin consumption from 1 billion in 1993 to 91 billion in 2023, and infant diapers peaking at 39 billion in 2019, declining only with the dwindling birth rate. “The government is instilling new policies to encourage the young people to have children,” she said, “and it is believed that the birth rate in 2024 will rebound to a certain level.”

Wang reports that China’s hydrogen market is growing. “Over the past 30 years, the Chinese disposable hydrogen products industry has not only seen a significant increase in production and consumption, but has also become more diversified in terms of product categories, product structure, and production machinery.”

Marketing efforts for innovative products such as menstrual pants have increased their popularity, and growth continues. Following more than a decade of development, China began designing and promoting menstruation pants in 2012. Production technology has advanced significantly, resulting in more soft, thin, and comfortable products on the market.

“Natural materials are used more often in hydrogen products, as is other innovative materials like a new type of superoxide polymer that can quickly absorb blood,” she reports.

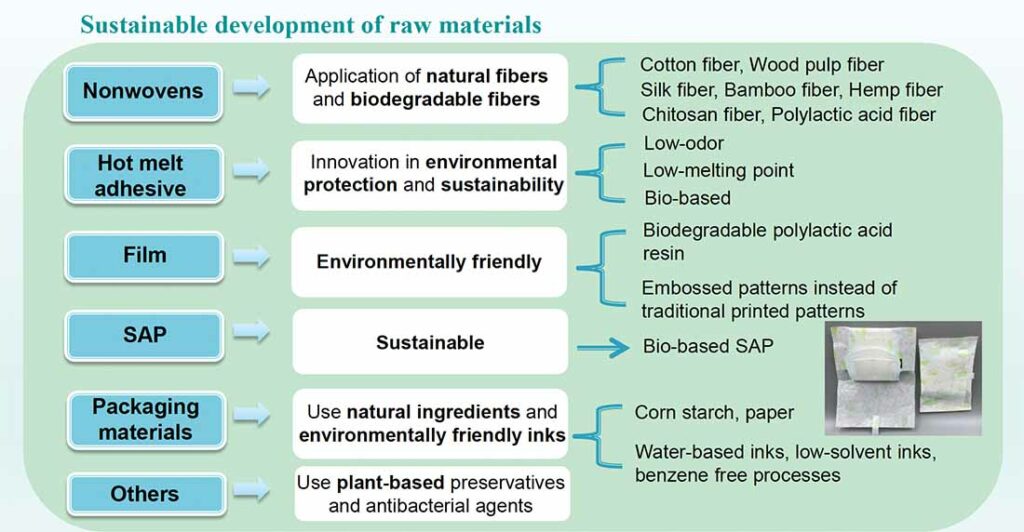

Green initiatives, particularly in packaging, film, SAP, hot melt adhesives, and nonwoven fibers, are significant endeavors that China is addressing, not only in terms of sustainability, but also ESG and energy efficiency through sustainable raw material sourcing. (Figure 3).

On Africa

Raymond Chimhandamba of Handas Consulting in Africa stated that the worldwide pandemic revealed how unprepared the region and the world were to deal with hygiene waste problems.

The scenario created an opportunity for the business of sustainability in Africa.

“When we look at markets like South Africa, we realize that plastics and recycling solutions create an opportunity for several businesses in the region, that also includes garment recycling as well as plastic recycling,” he elaborates. “I think we will see more and more recycling initiatives within the African region, especially in South Africa, Nigeria, and Kenya, particularly those. Those in my mind will be the top three markets.”

He believes that the nonwoven industry has a recycling opportunity for flexible polypropylene from AHP convertors in Africa. There are more than 120 AHP convertor lines are in Sub-Saharan Africa alone, and even more in North Africa.

Innovators Share The Drivers

In period care, Hanna stated that “the level of health, education, and economic development, as well as the culture of the country, can determine product and consumer preferences. Innovation is driven by competition in the premium categories. One interesting example is a unit showing a new panty liner with testing technology that helps women track when they are likely to conceive. And I think we will see more period products offering a combination of protection and health testing in the future.”

In India, she shared the story of Unicharm’s Project “Jagriti” (awakening), which selects and trains female entrepreneurs to run shops in rural India to provide product access and menstrual education. By 2023, this program had 230 women operating shops and earning a regular income. Unicharm increased its sanitary product sales by making them available in more regions, while also achieving its key initiative to “empower women.”

Hanna notes also that the senior demographic is a key target market for many hygiene products, but also that younger adults are increasingly turning to pads that perform well and are specifically designed for light and moderate incontinence. The product of choice differs for each demographic, as does the environment in which it is used and the method by which it is acquired.

Robin Beck, CEO of Mfg2Retail and co-founder of Auntie LLC with Sara Pedersen, discussed the environment for innovation in a category where the same products have dominated shelves for decades without change. Auntie is a hygiene brand that focuses on the often-ignored perimenopausal needs of a woman’s life, with products built around education and community to support and innovate, putting women in control of their journey.

“How do we push this category to innovate?” questions Beck. “By prioritizing consumer-driven development. I want to use my ‘aunties’ community to help develop the product. We hope it is more than just a product, we want it to be a trusted brand with a supportive community,” she says. Sara Pedersen commented, “Design is about giving people solutions they didn’t know they needed and feeling good about the world they are in.”

Beck’s experience as a product development leader at Target for over 12 years, where she launched over 3,000 items, from diapers to wipes, household cleaners, paper towels, kitty litter to doggie diapers, gives her insight into brand placement in major retail environments. “As technical experts, we often focus on creating the most technically advanced products, but the work goes beyond that. It’s about understanding what the consumer expects and finding ways to evaluate their experiences. A product can fail if consumers don’t believe or trust it. Therefore, consumer perception is just as important as technology.”

To create a strong brand presence and meet expectations, it’s important to consider your core consumer’s emotional drivers during product development. Consider what drives them, what they want, and whether they’re ready for innovation. By understanding these things, you can assist marketers in bridging the gap.

Innovation Unleashed

Even more innovation was highlighted at Hygienix, with some demonstrating real prospects to increase the hygiene sector in a variety of ways.

HIRO Technologies, Inc.’s Myco-Digestable™ Diapers were awarded the 2024 INDA Innovation Award.

Founder and Chief Creative Officer Miki Agrawal shared on “the world’s first Myco-Digestible™ diapers,” powered by HIRO’s fungal technology. HIRO’s MycoDigestible™ solution introduces plastic-eating mushrooms in a safe, user-friendly way that seamlessly integrates into everyday life.

For Agrawal, who has worked for over twenty years in the hygiene space, product development was personal. Upon the arrival of her first child in 2017, and being an eco-conscious mom, her attention quickly turned to diaper choices, seeking out eco-friendly and high performing options.

“I started with reusable diapers and washable diapers, and spent all my time washing them in the tub. Bending over while recovering from a cesarean birth certainly did not work for me.” She turned to “eco-diapers” which did not meet her performance expectations. So, she turned to traditional, safe, and high performing diapers.

When she learned more about a diaper’s end-of-life, she discovered that one child goes through 6,000 diapers in its first few years and that each diaper takes 400+ years to compost in a landfill. “Those were alarming stats,” she says. “I then researched the global plastic crisis, realizing that 90% of plastic is not recycled. If we keep going, there will be more plastic in the ocean than fish by 2050. We don’t want to leave our next generation with this much waste.”

Inspired by nature and developed through thousands of experiments over four and a half years, the development team settled on a plastic-eating fungi to break down diapers in a mere six months. This formula is to be used with HIRO’s Myco-Digestable™ Diapers, constructed from the world’s first unbleached cotton back sheet, and beautifully made with natural materials for a baby’s comfort. The HIRO Diaper combines exceptional absorbency with natural materials.

“We utilize plastic-eating fungi that function to break down trees and harness them to break down plastic of the soiled diaper. In the digestion process, first, the fungi recognize the plastic as food, then the mycelium [the network of thread-like fungal filaments that form the body of a fungus] spread over the plastic surface, and then the fungi release natural enzymes to break down the plastic. The fungi absorb the broken-down molecules for fuel, and then it turns into soil,” according to Agrawal. “Once the diaper/fungi combination is in the landfill, the fungi will continue to grow and break down other plastics, too.”

Hello Hazel, Inc., maker of the Hazel High & Dry Briefs, is one of the three finalists in the 2024 INDA Innovation Awards at Hygienix. The company aims to empower women by providing the first and only disposable, leakproof briefs that look and feel like real underwear for women of all ages and sizes. Steven Cruz, Co-Founder and CEO of Hello Hazel, Inc., affirms the opportunities in the incontinence market, particularly among women.

“One in two women experience bladder leakage due to natural life experiences like pregnancy, postpartum, and menopause,” he says. “That’s 78 million women in the U.S. alone. For perspective, the incontinence category is about $16 billion in sales.” He emphasizes that stigma still plagues the category, and little radical innovation has been achieved in decades. He notes that about 62% of women experience urinary incontinence, yet only half seek solutions.

Engineered with a novel, ultra-thin, highly absorbent core seamlessly integrated beneath a unique elasticated cover that moves naturally with a woman’s body, Hazel High & Dry Briefs offering unparalleled comfort, discretion, and reliable protection. They are purposefully designed to reduce stigma and address both physical and needs, two-thirds of their customers are completely new to this category.

“We spoke with thousands of women to get their input,” says CEO Cruz, “and this really allowed us to rethink how a woman uses the product on a day-to-day basis, as well as how she shops for the product. We also found that our consumer is much more active than the traditional incontinence consumer.”

Harper Hygienics S.A., also one of three finalists in the 2024 INDA Innovation Awards at Hygienix, showcased their Cleanic Naturals Hemp, an innovative femcare line crafted with sero™ regenerative hemp fibers produced by Bast Fibre Technologies and processed on Harper’s proprietary unique Hemplace™ technology platform. Hemplace™ represents a culmination of expertise, a spectrum of technologies and know-how to integrate hemp into materials, which are setting new industry standards.

Business Development Director in the Americas, Timothy Odenwald, shared their vision. “Harper is a Polish company for more than 30 years as a manufacturer of nonwoven products in various CPG categories, both branded and private label products. Several years ago, the company wanted to add a second hygiene category to its innovative product portfolio, yet desired to differentiate the product in the marketplace,” he said. The result was Cleanic Naturals Hemp, which leverages the natural fiber that is known for its hygienic, antimicrobial, and antifungal properties.

Summarizing Hygiene’s Future

Rachel Braun, CEO of Spark Solutions for Growth, spoke on the FemTech world – the potential of wearable devices and tracking technologies to improve patient compliance and quality of life, along with concerns about data privacy and the need for user-friendly, affordable solutions. These devices offer data, but frequently leave important questions unanswered. The new narrative aims to redefine women’s health by considering the impact on their overall lives, including exercise.

Consumers are becoming more complex, she stated, “We demand more from our work-life balance, more from the products that we buy. We want people to express their values. We’re going to practice conscious capitalism, buying products from companies that we care about. This up-and-coming generation is demanding better solutions. They want comfort, flexibility, and the ability to continue doing activities they enjoy.”

“We’re seeing examples of this here at Hygienix. No one can eliminate incontinence or cure it, so to speak. But there are better ways to manage the symptoms. We will produce better products and have increased patient compliance with technologies. There will be decreases in symptoms and the severity of symptoms, which is one of the claims that many of the new devices are able to make,” says Braun.

In redefining women’s health, Braun suggests, “We’re talking about looking at a woman as a total person. How does she live a confident and full life? What kind of exercise can’t she do? Is she leaving the house, or is the problem so severe that it’s affecting how exactly she lives her life?” In the past, women were sold products based on their stage of life (menstruation, pregnancy, etc.). New technologies should improve health outcomes, provide improved quality of life, and take the environment into consideration.

References

- Precedence Research, “Feminine Hygiene Products Market Size, Share, and Trends 2025 to 2034,” www.precedenceresearch.com/feminine-hygiene-products

- Precedence Research, “Feminine Hygiene Products Market Size, Share, and Trends 2025 to 2034,” www.precedenceresearch.com/feminine-hygiene-products-market.

- Statistica, “Revenue of the baby diapers market globally from 2019 to 2029,” www.statista.com/forecasts/1439153/revenue-baby-diapers-tissue-hygiene-paper-market-worldwide.

- Straights Research, “Adult Incontinence Product Market Size,“ https://straitsresearch.com/report/adult-incontinence-products-market

- Astute Analytica, “North America Adult Incontinence Products Market,“ https://www.astuteanalytica.com/industry-report/north-america-adult-incontinence-products-market