The coronavirus pandemic could see around 265 million people suffering from acute hunger by the end of the year unless swift action is taken to ensure food supply chains keep running, according to the World Food Programme. This represents a doubling of the 130 million estimated to suffer from food shortages in 2019.

The COVID-19 crisis has acutely highlighted the issue of food security and the resilience of future food systems. The increased use of agricultural textiles could form part of the solution for addressing this global challenge.

Agrotextiles defined

Textiles in their simplest form have been used in agriculture for thousands of years to protect plants – as well as animals – against extreme climatic conditions. They offer shade, help maintain soil humidity and increase soil temperature, and can protect crops from insects and weeds.

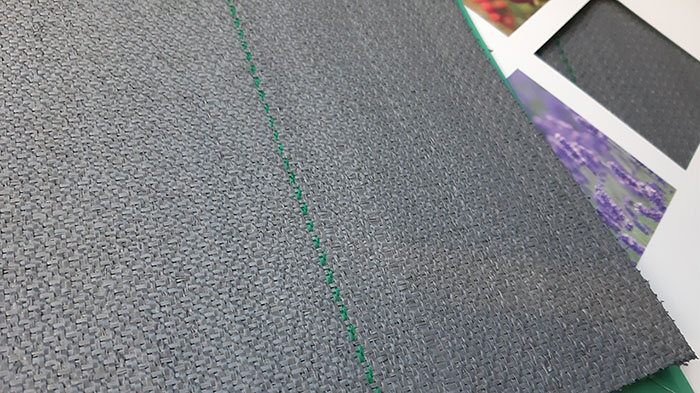

“Agrotextiles” is a relatively recent term, having been used since the 1980s. It encompasses woven, knitted and nonwoven fabrics and other textiles used in agriculture, forestry, horticulture, floriculture (flower farming) and landscape gardening, as well as in fishing and aquaculture (fish farming).

It includes fabrics for livestock protection, shading, weed and insect control, and for extending the growing season of plants and crops. The most common agricultural applications are covers for greenhouses and crop protection products.

In principle, the use of agrotextiles generally leads to agricultural products with enhanced quality, higher yields and less damage. They can also help farmers decrease their use of herbicides and pesticides, thereby reducing environmental pollution, as well as input costs.

For most end-uses, agrotextiles require suitable tensile strength and good permeability characteristics with no significant deterioration under the influence of climatic extremes. The properties of agrotextiles are dependent on the fibers from which they are produced and on the type and conditions of their manufacture.

However, advanced technical agrotextile products have become commonplace only in the past two or three decades, with fibrous materials, particularly synthetics, beginning to replace plastics in certain applications. In particular, the use of nonwovens, especially spunbond fabrics, is increasing.

However, advanced technical agrotextile products have become commonplace only in the past two or three decades, with fibrous materials, particularly synthetics, beginning to replace plastics in certain applications. In particular, the use of nonwovens, especially spunbond fabrics, is increasing.

Rise in global population

The main growth driver for the agrotextile sector is the rise in global population, which is increasing the demand for more and better quality food grown in soil that is often compromised.

The United Nation’s Food and Agricultural Organization (FAO) predicts that global food production will have to increase by 60-70% from its current level to feed a population of 9.2 billion by 2050 (up from 7.6 billion in 2018), of which developing countries will account for around 8 billion people. In particular, Asia will contribute 41% and Africa 47% towards this growth in 2050.

This means that an additional 1 billion tonnes of cereals and 200 million tonnes of meat will need to be produced annually by 2050, when it is estimated that 80% of the world’s population will reside in urban areas. “In order to intensify production by that much on our finite earth, immense effort will have to go into new, better and more intensive ways of producing our food,” stated former FAO director-general Jacques Diouf a decade ago.

Moreover, feeding in excess of 9 billion people will require the expansion of irrigated areas as well as the wider use of management practices to improve the efficiency of water use, such as water “harvesting” techniques and conservation of soil moisture.

This also means an estimated 109 million hectares of new land (about 20% more land than is represented by Brazil) will be needed to grow enough food to feed the global population, assuming traditional farming practices continue as carried out today.

At present, more than 80% of the land that is suitable for raising crops worldwide is already in use. Historically, however, some 15% of that area has been laid waste by poor management practices.

Modest utilization

Based purely on these estimates for population growth and food demand, the long-term outlook for agrotextiles appears healthy. But their utilization thus far has been modest considering the size of the current and potential area dedicated to crop growing and the substantial economic advantages that can be gained from using such materials in agriculture.

In many industrialized countries, particularly with increasing urbanization and more land being used for biofuel production, the total land area dedicated to agriculture and horticulture is declining, which is placing huge pressures on governments and economies to feed the ever-expanding global population.

Fortunately, better use of soil and higher outputs through improved efficiency and productivity has partially overcome this problem – and the use of agrotextiles has contributed to this development.

Market potential

Agrotextiles is one of the smaller categories of technical textiles. A recent report from Grand View Research suggests the agrotextile end-use segment accounted for sales of US$4.5 billion in 2019, out of a total global technical textile market size estimated at US$176.6 billion. However, this sector is among those with the strongest growth predictions based on the projected increase in global population and the demand for higher-quality food.

In major developing countries, particularly Brazil, India and China, the market potential for agrotextiles is huge. However, many of these regions are still based on a rural economy with substantial populations living in rural areas that rely on subsistence farming.

At present, some 2.5 billion people – around a third of the world’s population – are smallholder farmers and their families. For many of these, the cost of purchasing additional technology – even basic agrotextile fabrics – may be prohibitive without significant government subsidies.

Meanwhile, food security has increasingly become a major issue worldwide. According to the FAO, food security exists “when all people, at all times, have access to sufficient, safe and nutritious food to meet their dietary needs and food preferences for an active and healthy life.”

Climate change

This issue is being accentuated by the threat of climate change. Some studies have revealed a possible loss of 10-40% in crop production in such countries as India, owing to the predicted rise in global temperature by 2050-60. The current coronavirus pandemic has only exacerbated these problems.

As a result, a key driver for the agro-tech sector is to increase productivity by improving crop yields, along with improving the efficiency of land, water, ancillary resources and land management – and conserving the environment.

The current agrotextiles market is marked by contrast. The fisheries sector, for example, is in crisis worldwide with a reduction in fish stocks and fishing fleets. According to the UK-based consultants David Rigby Associates, fishing methods are becoming more industrialized, replacing older, small net and line fishing techniques.

Environmental concern is strengthening over the indiscriminate use of large nets and this pressure may halt this trend. However, the development of aquaculture (both freshwater and seawater) has created new requirements, such as nets capable of prolonged immersion and improved abrasion resistance.

In agriculture and horticulture, there has been a steady reduction in the size of cultivated area owing to better use of the soil and higher outputs through improved efficiency and productivity. Technical textiles have contributed to this development, but their costs tend to limit them to developed countries or where their use is considered to be essential.

Biodegradable materials

Meanwhile, there is growing interest in the use of biodegradable materials, which has resulted in increased awareness of the use of natural fibers and bio-based polymers.

However, the overall trends in the agrotextiles market are related to the capacity of the sector to accept innovations – and to be able to pay for them. On a technical level, the development of additives has made it possible to improve, or enhance, the properties of synthetic fibers. As a result, photosynthesis can be slowed to facilitate blanching of certain vegetables, for example.

Although future volume growth rates for agrotextiles appear to be relatively modest, this is partly due to the replacement of heavier-weight “traditional” textile items, including jute and sisal sacking and twine, which are still favored in developing countries, with lighter, longer-lasting synthetic fiber substitutes, such as polypropylene.

Nonwovens potential

Lightweight spunbond fabrics are increasingly being used for shading, thermal insulation and weed suppression, while heavier woven, knitted and nonwoven constructions are employed for protection against wind and hail. Further, fibrillated and extruded nets are replacing traditional baler twine for wrapping modern circular bales.

Capillary matting is used in horticulture to distribute moisture to growing plants, while the bulk storage and transport of fertilizer and agricultural products is increasingly being undertaken using woven polypropylene flexible intermediate bulk containers (FIBCs) or “big bags” instead of jute, paper or plastic sacks.

Meanwhile, fish farming uses specialized netting and other high-tech products. For example, high-performance fibers, such as high-modulus polyethylene (HMPE) like Dyneema and Spectra, are being employed in the fishing industry for the manufacture of lightweight, ultra-strong fishing lines and nets.

Recent news

In Europe, one of the leading producers of agrotextiles with the Phormium brand is IFG Cresco, part of the International Fibres Group, which in 2017 acquired Low & Bonar’s agrotextiles business and its associated production unit in Lokeren, Belgium, for €7 million. (Low & Bonar is now part of Germany-based Freudenberg Performance Materials, while IFG, a manufacturer of polypropylene, polyethylene, polyamide fiber and filament yarns, is part of Swedish industrial group Duroc.)