Staple fibers hold a large share of the global fiber market, with last year’s output comprising about 57 million tonnes in a total market size of almost 106 million tonnes. Staple fiber dynamics, however, have been slower than in the filament business, as their position in the market has continuously lost weight in recent decades. Staple fibers held a market share beyond 80% until the early 1990s, when they began to diminish to the current level of around 55%. Nearly half of the annual volume in the century was cotton, with the synthetic fibers segment tolerably stable at about a third of the market, while viscose fibers doubled in share to 11% at present.

The long-term development of the staple fiber market is illustrated in the below chart. The entire segment has experienced an average annual growth rate of 1.8% since 1980, slower than the expansion of the world fiber market at 3.0%. Volumes grew from 29 million tonnes to more than 57 million tonnes at present.

The previous year’s performance suffered from a decline of 1.0% after strong growth led by cotton in the two years prior. Cellulosic manmade fibers, the eldest manmade fiber derived from wood, continued their breathtaking recovery since 2002 with viscose fibers arriving at a new all-time high and acetate tow contraction decelerating. Synthetic fibers witnessed their second consecutive decrease, following a weakening of the market for polyester and acrylic (Figure 1).

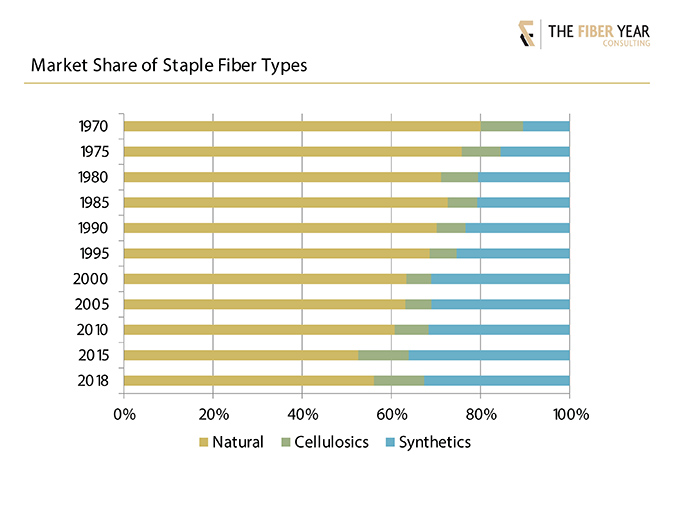

The long-term staple fiber competition used to be in favor of manmade fibers at the expense of natural fibers, as the availability of agricultural land, advantages in prices, security of supply, enhanced properties and economies of scale have been key drivers of this replacement process. Almost half a century of staple fiber history reveals an amazing trend reversal recently. Natural fibers were able to enlarge their market position while synthetic fibers lost weight, which may be associated with the serious issue on plastic waste from synthetic fibers. Meanwhile, viscose fibers kept on outperforming the synthetic staple fiber market in the tenth consecutive year and managed to triple their manufacturing volume in just fifteen years. This momentum is expected to last, supported by an unprecedented size of new raw material capacity commissioned in 2019 (Figure 2).

Changing dynamics in fiber cultivation and manufacturing become obvious in the next chart, Figure 3. Oil-based fiber material has considerably lost growth momentum, while cellulosic manmade fibers outperformed the total market in the century. A further breakdown into the both fiber types in this segment underlines the exceptional strength of viscose staple fibers, celebrating decennial jubilee for being the only mainstream manmade staple fiber with nonstop annual growth and outperforming yearly growth dynamics of polyester staple fibers. Their average annual growth rate since 2010 accounts for even 7.7%, while acetate tow dropped 1.0% due to the ongoing shrinkage of cigarette shipments.

The market includes a variety of additional fibers such as wool, bast and other natural fibers, as well as some small-scale synthetic fibers. The latest development will briefly be touched upon.

Natural fibers were able to enlarge their market position while synthetic fibers lost weight, which may be associated with the serious issue on plastic waste from synthetic fibers.

Previous year’s wool supply fell 2.3% to 1.1 million tonnes, the lowest in seven years, and production is under pressure due to just modestly increasing flock numbers, while the combination of strong Chinese demand and flat wool supply has lifted prices in the last two years considerably. The total bast fiber segment is expected to have grown 1.9% to 3.9 million tonnes with the strongest dynamics in flax output, up 7.8% to 259,000 tonnes, following growth mainly in France and Belgium; and jute, up 2.1% to 3.3 million tonnes, while the remaining fibers softened.

Acrylic fibers – second-largest fiber in the synthetic business – have continued their long-term contraction in the seventh year in a row, with output falling 7.9% to 1.6 million tonnes. Profit margins eroded by high feedstock prices for acrylonitrile and have prompted manufacturers to cut operating rates or to shut down plants. Polypropylene production rose 3.0% to 1.4 million tonnes; market forces are quite different to most other textile segments in the spinning industry as Europe and the U.S. take a leading position. The reason for this structure is that polypropylene fibers are mainly processed into nonwovens.

This article is based on material abstracted from the textile yearbook, The Fiber Year, which covers global trends in manmade and natural fiber production, including nonwovens and unspun materials. The Fiber Year provides trade data for main markets and contains several contributions from industry experts in the area of biopolymers, cotton, wool, viscose and synthetics, nonwovens, as well as ITMF textile machinery shipments. A table of contents is available at https://thefiberyear.com/home/.

In the next installment of “The Fiber Year” column, an outlook of the fiber market size in major economies will be highlighted.