As Industry-Wide Circular Solutions Rise, Consumer Education is Critical

On March 8, 2024, South Carolina’s Charleston Water System (CWS) settled a class action lawsuit against the wipes retailers and manufacturers Costco, CVS, Procter & Gamble, Walgreens, Target and Walmart.

It should go some way to ensuring that all wipes marketed to consumers across the USA will be truly flushable and that packaging for all non-flushable wipes will clearly indicate they should not be flushed.

CWS brought the suit in January 2021 seeking injunctive relief to remedy costly and ongoing damage to sewer systems and treatment facilities due in a significant part to the inability of allegedly flushable wipes to break down, often clogging wastewater infrastructure and causing sewer overflows that damage the environment.

Kimberly-Clark, which manufactures Cottonelle flushable wipes as well as non-flushable wipe products, previously settled with CWS in January 20222 and its products now already comply with the suit’s

requirements.

Significant Victory

“When we filed this suit, only the wipes of one brand were actually flushable and no product packaging offered disposal instructions that were clearly visible,” said Mark Cline, CEO at CWS. “We’ve won a very significant battle, as wipes have been public enemy number one for the entire waste-water industry since they were invented.

“We knew this litigation would be tough and that the stakes were high for these international corporations, so we’re extremely pleased with the skilled work of our counsel. These settlements bring significant benefits to wastewater utilities nationwide and their customers, while reinforcing the commitments of the companies to being good corporate and environmental stewards. It’s a major step forward for us and the whole country in that respect.”

The settlements commit the defendants to meeting an international flushability standard supported by the wastewater industry, with two years of confirmatory performance testing, and significant non-flushable wipes labelling enhancements.

“The final battle in the wastewater industry’s war against wipes is still to come and that involves changing human behavior,” Cline said. “We hope consumers will follow the clear instructions on the packaging. If so, customer sewer costs would go down and the vast majority of sewer overflows nationwide would be eliminated, making our environment the big winner.”

Whitechapel Fatberg

The disposable nonwoven wipes industry has gone through rather a lot over the past decade and the issue of flushability has never been far from top of the agenda, following horror stories of huge ‘fatbergs’ – mountains of oil and grease congealed with wet wipes and other sanitary products blocking sewer systems.

The UK has been particularly impacted by them and in September 2017 the largest to date was discovered in a sewer under Whitechapel, London – at 820 feet long and weighing 130 tons! A portion of this has subsequently been exhibited in the Museum of London.

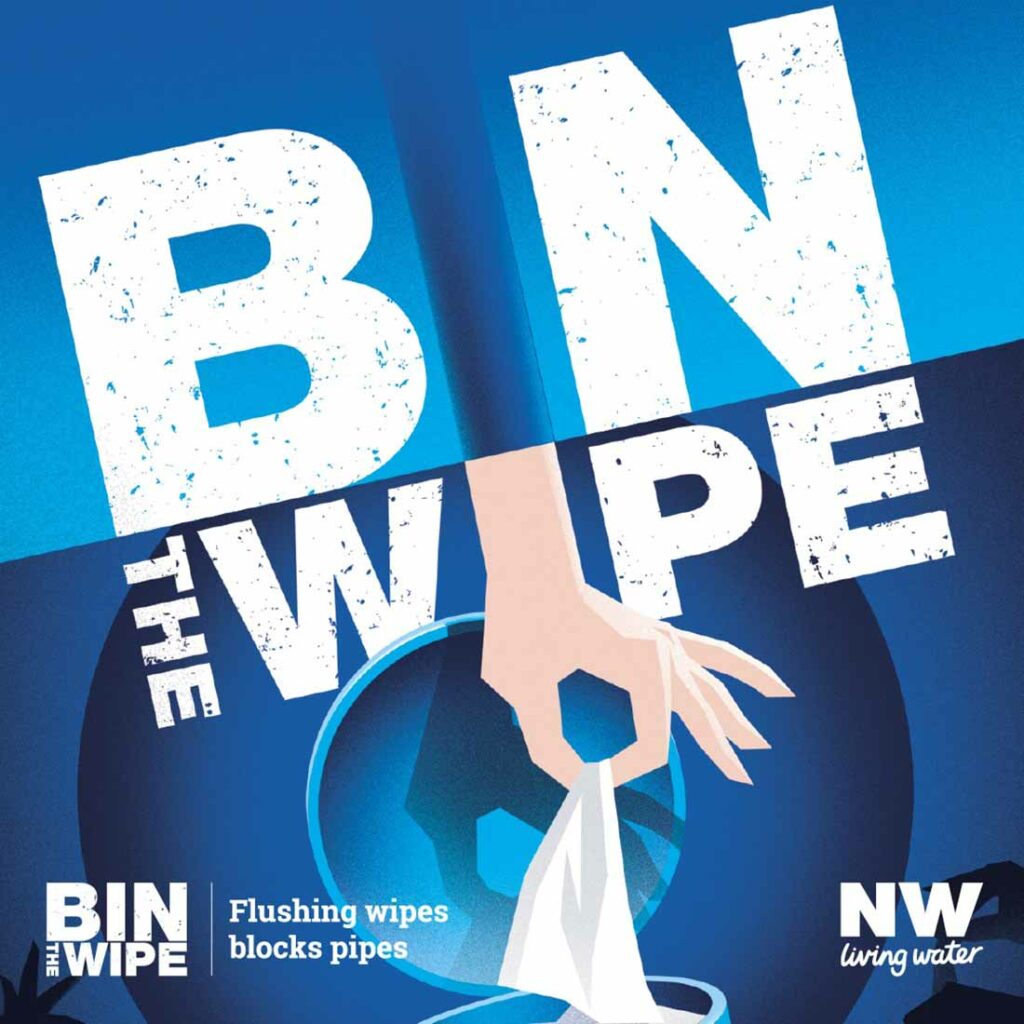

Bin the Wipe

The UK has now gone a stage further than the USA, with Water UK having just shelved its “Fine to Flush” certification scheme for wipes introduced in 2019. The certification’s label featured a toilet seat and a check mark.

In October 2023, the UK Government launched a consultation on potentially banning wet wipes containing plastic nationwide, as part of its wider Plan for Water.

Now, however, in place of “Fine to Flush,” Water UK has introduced a new “Bin the Wipe” campaign aimed at ending consumer confusion and advising that all single-use wipes, whether flushable or not, should no longer be flushed down toilets.

In the United States, INDA, Association of the Nonwoven Fabrics Industry is engaging in flushability as a priority. “We are tracking at least 25 different bills or initiatives at the state, federal, and, in some cases, even the municipal level,” says Matt O’Sickey, INDA Director of Education & Technical Affairs. “

Many U.S. state’s initiatives will be affected the Wastewater Infrastructure Pollution Prevention and Environments Safety (WIPPES) Act (H.R. 2964), recently passing in the U.S. House of Representatives, working its way through Congress. “This bipartisan legislation is intended to address the growing problem of sewer system clogs caused by improper disposal of consumer wipes that are not intended to be disposed of in toilets,” says O’Sickey.

Flush Right

In the fall of 2023, INDA joined forces with CASA, the California Association of Sanitation Agencies, and RFA, the Responsible Flushing Alliance, along with a contracted engineering firm, to conduct a practical micro-study on wipes flushability, in response to a directive from the 2021 Wet Wipes Labelling Law AB 818. The goal was to see what Californians are flushing to help form consumer education campaigns. The team spent over two weeks at the Inland Empire Utilities Agency in Southern California and Central San in Contra Costa County in Northern California, analyzing material pulled from the waste stream.

“We collected 1,745 samples over four days – two days in northern CA and two days in southern CA. We also collected the items during peak flow time so that it could be a good, indicative sample,” says Lara Wyss, President, Responsible Flushing Alliance. “

The results indicated that flushable wipes are indeed biodegradable, with .9% of what was collected being Nonwoven – Labeled Flushable. The biggest culprit collected were paper products at 52.8%, and second was Nonwoven – Labeled Do Not Flush at 34.1%. Feminine Hygiene and Trash collected was 12.1%.

“Our approach is to educate consumers to look for the ‘Do Not Flush’ symbol on packaging, and explain why that’s important,” says Wyss. “This study really verified that this is the right approach.”

Single-Use Plastics Directive

All of these occurrences are definitely a blow for the nonwoven wipes supply chain – from machine builders and fiber suppliers to converters – which has worked diligently to enable the production of fully flushable wipes over the past 20 years.

All of this work did, however, help the supply chain in responding to the European Union’s Single-Use Plastics Directive (SUPD) to some extent.

This legislation, first announced in 2019, was devised to take action against the ten single-use plastic products most commonly found discarded on European beaches, including both wipes and nonwoven-based femcare products.

Since July 2021, any of these products containing plastics have had to carry prominent warning labels and extended producer responsibility (EPR) for the collection of the single-use products from European beaches and their disposal comes into place in December 2024.

No brand, of course, could contend with issuing products carrying both its logo and a prominent warning label on its packaging, but as things turned out, the SUPD couldn’t have come at a worse time, with preparations for it coinciding directly with the Covid-19 pandemic.

Challenges

In a memorable presentation, Martin Henderson, technical manager for wipes converter Rockline Industries UK, described the multi-faceted challenges the industry faced in 2019 and 2020.

“When the pandemic hit, the demand for products and consumer priorities changed overnight and in many cases it just simply was not possible for the industry to react in time,” he said. “The demand for disinfecting wipes flew off the shelves while skin care wipes dropped off significantly as people stayed at home, and new product formats evolved as manufacturers scrambled to cope with the shift in demand.

“Meanwhile, the emergence of the SUPD really put huge pressure on our industry to make changes to the products we supply and come up with sustainable solutions. Even in normal circumstances this wouldn’t have been easy, but in the midst of a pandemic the challenges were magnified. In the UK at least, the pressure on plastic has been intensified by the media and NGOs, some of whom have directly called out UK retailers, which has accelerated product changes and led brands to transform entire product portfolios to move away from plastic.”

Manufacturing lines were repurposed and production schedules streamlined which all came at

a cost, Henderson added, and when adding 100% cellulose products into the mix the challenges became

even greater.

“It’s widely known in the industry that 100% cellulosic products cause challenges throughout the supply chain and when consumer portfolios changed in a matter of months, the impacts were felt by both roll goods manufacturers and converters. Reduced efficiencies and increasing materials costs were unavoidable and the demand for viscose and other cellulose-based fibers began to increase drastically at just the wrong time.”

Nevertheless, Rockline UK fully succeeded in removing 2,400 tons of plastic from its wipes in 2021, compared to the previous year. The successful response to the SUPD is further underlined by a second UK wipes brand, NicePak, which supplies an annual 500 million packs of wipes to global brands and retailers. In 2018, just 9% of these were plastic free. By 2022 the percentage had jumped to 90%.

New Cellulosics

In parallel, cellulosic fibers for the flushable wipes market have also advanced rapidly in a very short space of time.

Lenzing, for example, has recently launched upgraded Veocel™ shortcut lyocell fibers which not only have higher dispersibility but also benefit from a new finish which improves processability and enhances efficiency in wetlaid nonwoven wipes production by providing protection against mechanical stress at commonly used water temperatures (0-40°C). This helps to avoid the creation of fiber lumps during the opening and dilution of the fibers in preparation tanks. The finished product also has enhanced physical quality and appearance because the finish improves web formation during the process.

The latest Veocel fibers are now being employed in products such as Albaad’s Hydrofine – the leading flushable wetlaid wipe sold in Europe.

Healthy Growth

Whatever’s next for the nonwoven wipes industry, it has certainly come a long way since inventor Arthur Julius first trademarked his original Wet-Nap in 1958 and five years later sold it to Colonel Harland Sanders for use in his Kentucky Fried Chicken restaurants.

The industry exploded in the 1970s and has been growing ever since – in 2024 Smithers puts the value of the global consumer wipes market at $18.8 billion, and that of industrial wipes at $4.3 billion. Annual growth in the coming years is put at a healthy 6.2% and the market is currently consuming around 1.5 million tons of nonwovens per year.

Similar demands to those made by the EU’s SUPD could soon arise in North America, following on from the CWS lawsuit and legislation such as the California Circular Economy and Plastics Pollution Reduction Act.

However, the hygiene and health benefits that wipes provide, along with their convenience, makes any outright ban on them as suggested in the UK highly unlikely, and meanwhile, the supply chain continues to develop ever-better performing and fully biodegradable materials.